38+ is mortgage interest still deductible

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Web If youve closed on a mortgage on or after Jan.

Which States Benefit Most From The Home Mortgage Interest Deduction

Web Under the Tax Cuts and Jobs Act TCJA the interest is deductible on acquisition debt up to a 750000 threshold for 2018 through 2025 down from 1 million.

. Web The mortgage interest deduction is a tax break for interest paid on the first 750000 of mortgage debt. No matter what your income you can deduct interest on a qualified mortgage if. 13 1987 your mortgage interest is fully tax deductible without limits.

Ad Refinance Your House Today. Web Is mortgage interest tax deductible. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage.

Web The easy answer is that the mortgage interest deduction doesnt phase out. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses.

And lets say you also paid. Refinance Your FHA Loan Today With Quicken Loans. So lets say that you paid 10000 in mortgage interest.

Web One of the biggest changes that was made is that a new cap was introduced on the amount of mortgage debt you can have before your interest is no longer fully deductible. Take Advantage And Lock In A Great Rate. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan.

Web Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing separately. ITA Home This interview will help you. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Also if your mortgage balance is. Above 109000 54500 if. Use NerdWallet Reviews To Research Lenders.

Homeowners who purchased their homes before December. Web If you took out your mortgage on or before Oct. Well Talk You Through Your Options.

Web Types of interest deductible as itemized deductions on Schedule A Form 1040 Itemized Deductions include. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Investment interest limited to your net investment.

Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web Also the TCJA lowered the cap on mortgage interest deductions from 1 million to 750000 for married couples filing jointly and from 500000 to 375000 for.

Calculate Your Monthly Payment Now. Web Most homeowners can deduct all of their mortgage interest. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Business Succession Planning And Exit Strategies For The Closely Held

Is Mortgage Interest Deductible In 2023 Consumeraffairs

Is It Possible To Cash Out My 401k And Make A Direct Deposit Into My Dad S Savings Account Quora

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction What You Need To Know Mortgage Professional

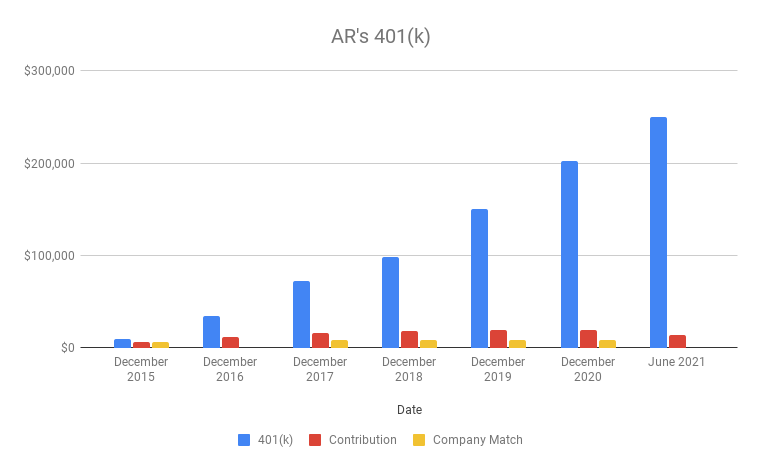

Why You Should Max Out Your 401 K In Your 30s

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

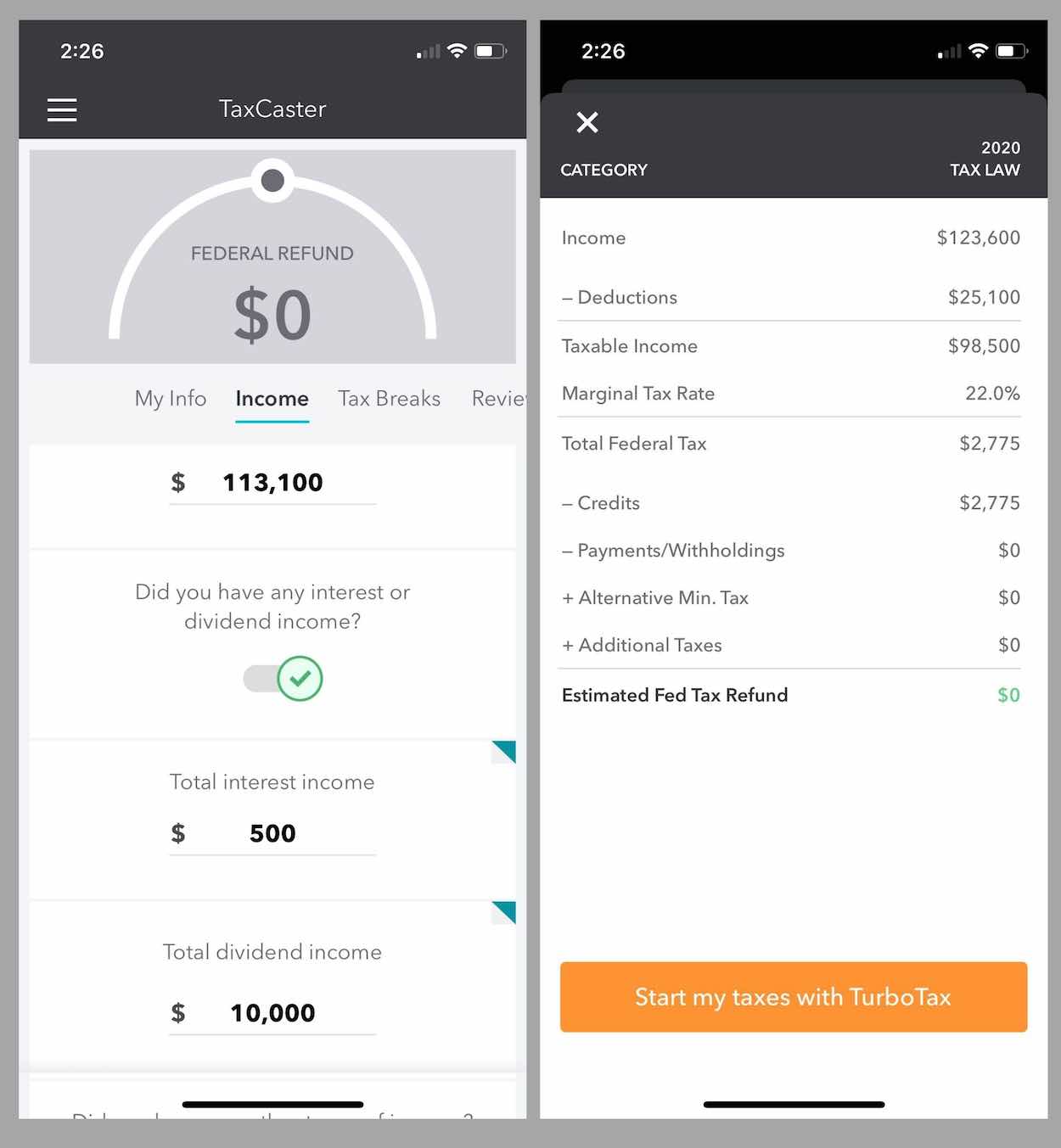

2021 Tax Planning Avoiding Capital Gains Tax In Retirement With Taxcaster

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Fixed Rate Mortgage Wikipedia

:max_bytes(150000):strip_icc()/TaxDeductibleInterest-10de394cbe27459ebb6f979a8f795083.jpeg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

How I Purchased My First Home At Aged 21 My Top Five Tips

Mortgage Interest Deduction Bankrate

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet