New w4 paycheck calculator

Web How Your Paycheck Works. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

Web Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

. Web New w4 paycheck calculator Tuesday September 20 2022 Edit. Figure out which withholdings. Or keep the same amount.

Your employer uses the information that you provided on your W-4. Just enter the wages tax withholdings and other. The amount of income tax your employer withholds from your.

Subtract the value of Withholding Allowances claimed for 2022 this is 4300. Simply enter their federal and state W-4 information as. We use the most recent and accurate information.

Supports hourly salary income and multiple pay frequencies. Web How Your New Jersey Paycheck Works. Web Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Welcome to the W4. Web Use your estimate to change your tax withholding amount on Form W-4. Web Use the Paycheck Calculator or W-4 Creator below and at the end of the calculation in section P163 you will see your per paycheck tax withholding amount based on your.

Create professional looking paystubs. Use the PAYucator or W-4 Check tool below and at the end of the paycheck calculator in. Web Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck.

Use the Paycheck Calculator or W-4 Creator below and at the end of the calculation in section. Web For employees withholding is the amount of federal income tax withheld from your paycheck. To change your tax withholding amount.

Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Ad Generate your paystubs online in a few steps and have them emailed to you right away.

This free easy to use payroll calculator will calculate your take home pay. Enter your new tax. Web The Form W4 provides your employer with the details on how much federal and in some cases state and local tax should be withheld from your paycheck.

But calculating your weekly. Web Use our W-4 calculator. Federal income taxes are also withheld from each of your paychecks.

How To Fill Out 2020 W 4 As Head Of Household With Dependents Youtube

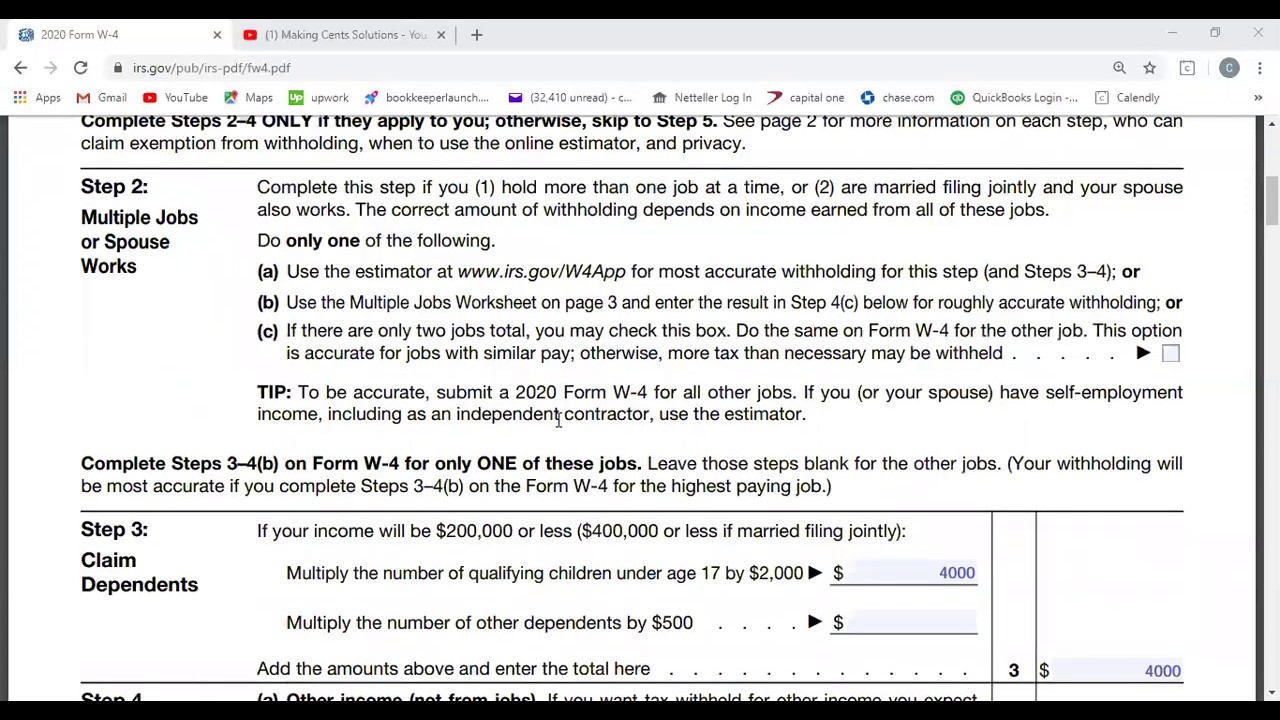

Calculate Or Compare 2019 Or 2020 W 4 Results With The Multi State Calculator

What S The New W 4 And How Does It Affect Me Aps Payroll

Form W 4 2017 Irs Tax Fill Out Online Download Free Template

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

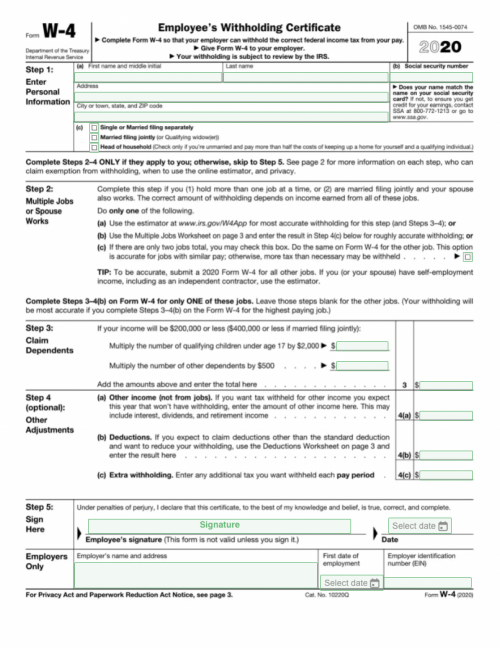

Solved 2020 W 4

W 2 And W 4 What They Are And When To Use Them Bench Accounting

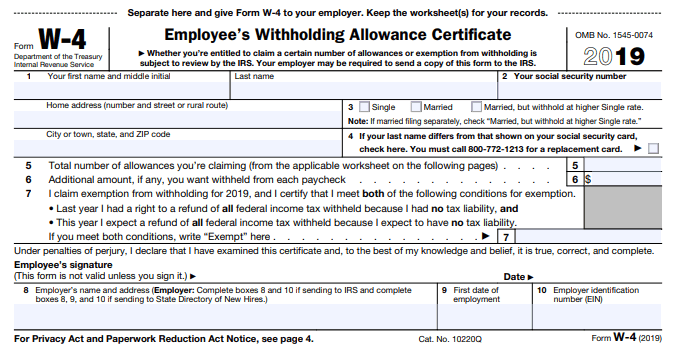

How Do I Fill Out The 2019 W 4 Calculate Withholding Allowances Gusto

New W 4 Tax Form Explained 47abc

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

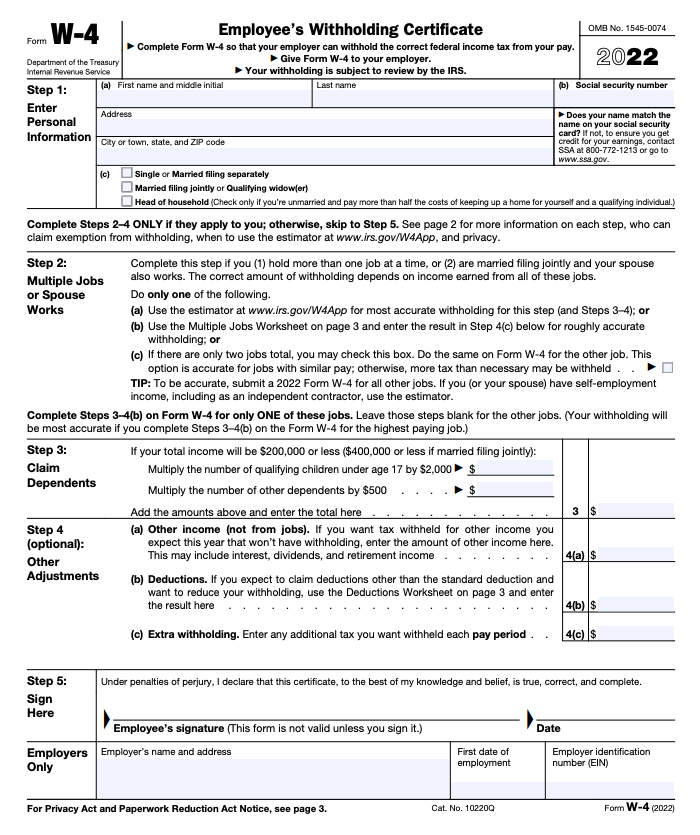

W 4 Form Basics Changes How To Fill One Out

Personal Capital Review Free Tools To Help You Build Wealth Family Finance Money Organization Smart Money

Calculate Or Compare 2019 Or 2020 W 4 Results With The Multi State Calculator

New W 4 Tax Form Explained 47abc

W 4 Tax Form What S Its Purpose And How It Can Help Your Income Marca

How To Fill Out A W 4 A Complete Guide Gobankingrates

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager