Car allowance tax calculator

Current 01 March 2022 - 28 February 2023. Discover The Answers You Need Here.

Company Car Or Car Allowance What Do I Choose Youtube

The 2000 paid with the trade-in.

. Automobile Benefits Online Calculator - Disclaimer. Tax payments 3. The new W-4 removes the option to claim allowances as it.

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. 45 per cent income tax when.

The Automobile Benefits Online Calculator allows you to calculate the estimated automobile benefit for employees. Income Tax Department Tax Tools MotorCar Calculator. 2023 Car Allowance Calculator.

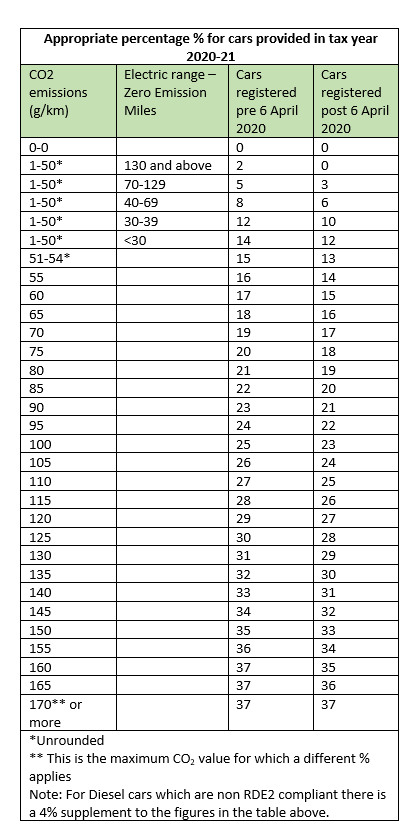

Using the HMRC calculator Choose fuel type F for diesel cars that meet the Euro 6d standard. 28 August 2016 at 1131AM. Your results You can use this service to calculate tax rates for new unregistered cars.

Add the car allowance to the basic salary and reduce the pension so that the actual amount in for pension is. 01 March 2021 - 28 February 2022. Taxability of Motor Car Perquisite.

Payment of a car allowance gives rise to a number of tax questions. Car allowance is based on the cost plus VAT x. Over the last few years there have been slight changes to withholding calculations for the federal income tax as well as Form W-4.

Car Allowance Salary Sacrifice Or Company Car Free Comparison Calculator Download Youtube. Select the nature of. It can be used for the 201314 to.

Tax rates 2021-22 calculator. 20 per cent income tax when income is between 12571 and 50270. Or you can use HMRCs company car and car fuel benefit calculator if it works in your browser.

10300 for company heads directors and. Tax rates 2021-22 calculator. 40 per cent income tax when income is between 50271 and 150000.

For example a survey mentioned on eReward found that the average car allowance differs from one employee level to the next in the UK. Taxability of other than Car Perquisite. Work-related car expenses calculator.

2022 Car Allowance Calculator. If you have the choice of either a company. The residual 13000 trade-in allowance is applied toward the first 26 monthly lease payments.

The customer owes sales tax on the 3000 cash payment. As amended upto Finance Act 2022. Super contribution caps 2021 - 2022 -.

Tax rates 2022-23 calculator.

2022 Car Allowance Policy Calculate The Right Amount

What Is The Average Car Allowance For Executives I T E Policy I

Should You Take A Company Car Or A Car Allowance

Car Benefits Data Input Calculation 2020 21 Moneysoft

Car Allowance Salary Sacrifice Or Company Car Is A Company Tesla Model 3 The Perfect Car Youtube

Florida Vehicle Sales Tax Fees Calculator

2022 Everything You Need To Know About Car Allowances

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

2022 Everything You Need To Know About Car Allowances

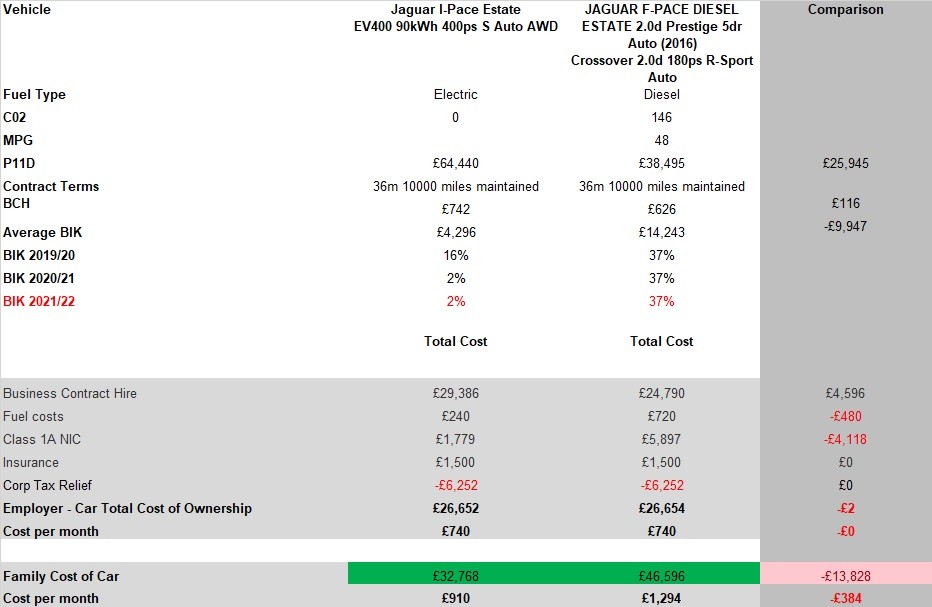

A Guide To Company Car Tax For Electric Cars Clm

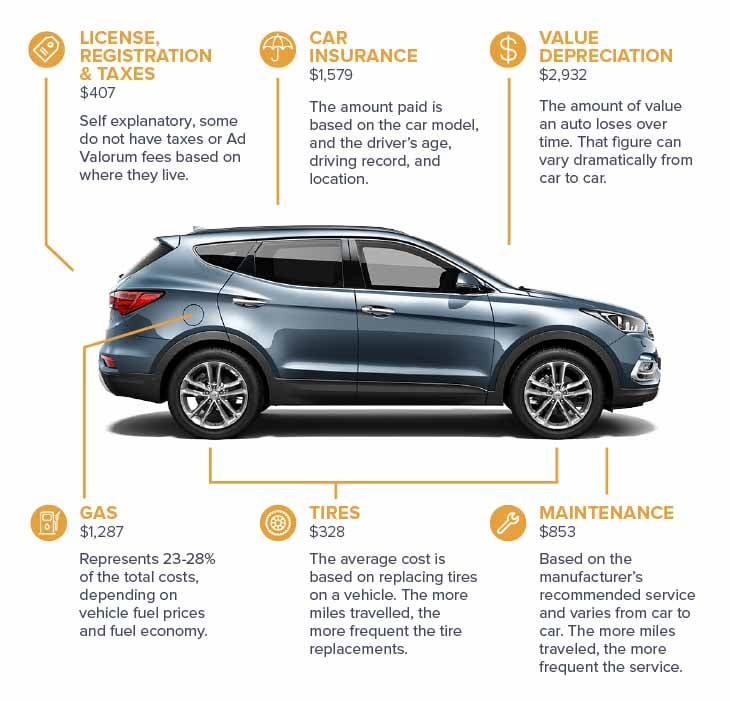

How To Calculate A Fair Car Allowance

How To Calculate A Fair Car Allowance

How To Create An Effective Car Allowance Policy I T E Policy I

2022 Everything You Need To Know About Car Allowances

Should You Take A Company Car Or A Car Allowance

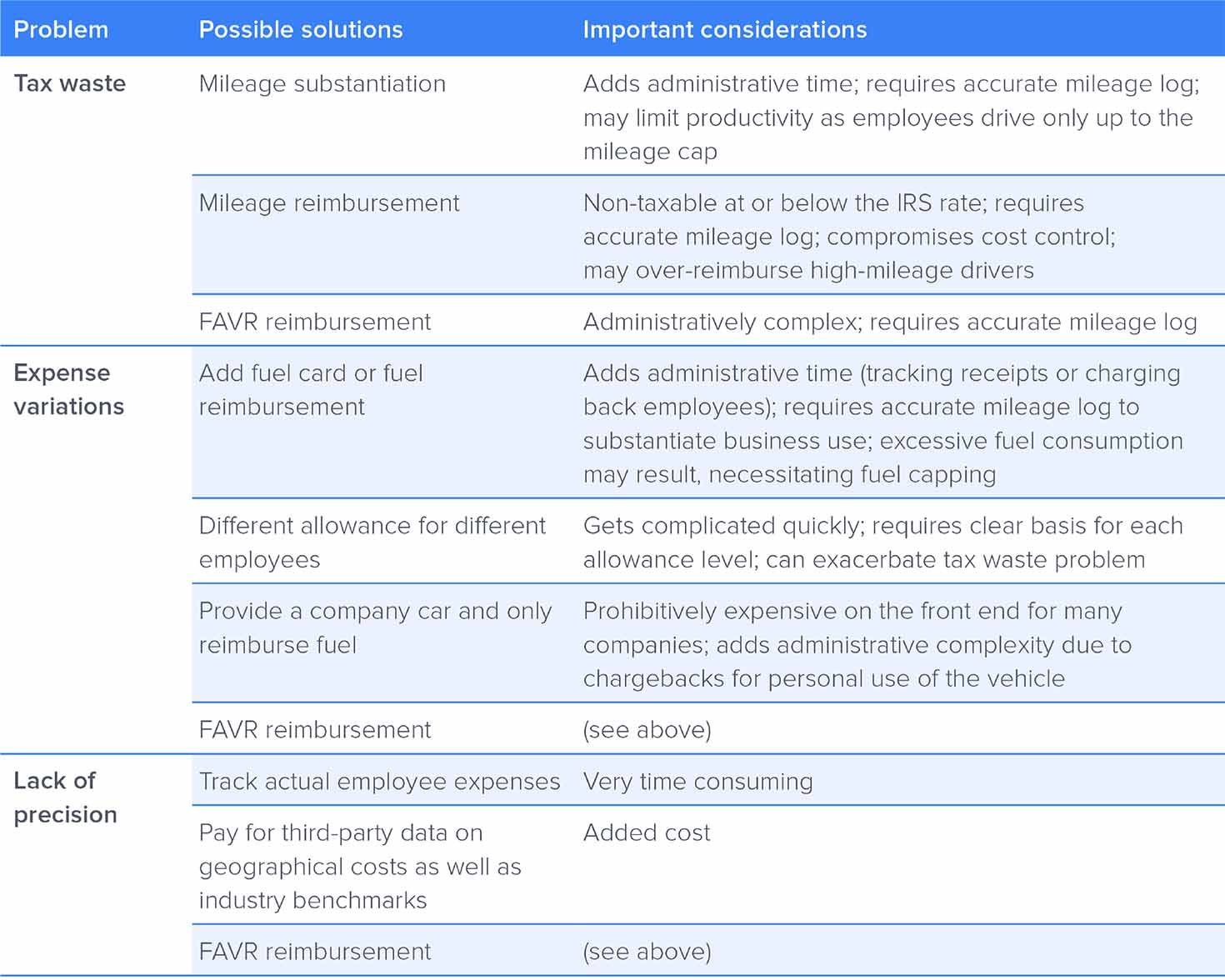

Allowance Vs Cent Per Mile Reimbursement Which Is Better

Car Allowance Vs Mileage Reimbursement